What you need to know

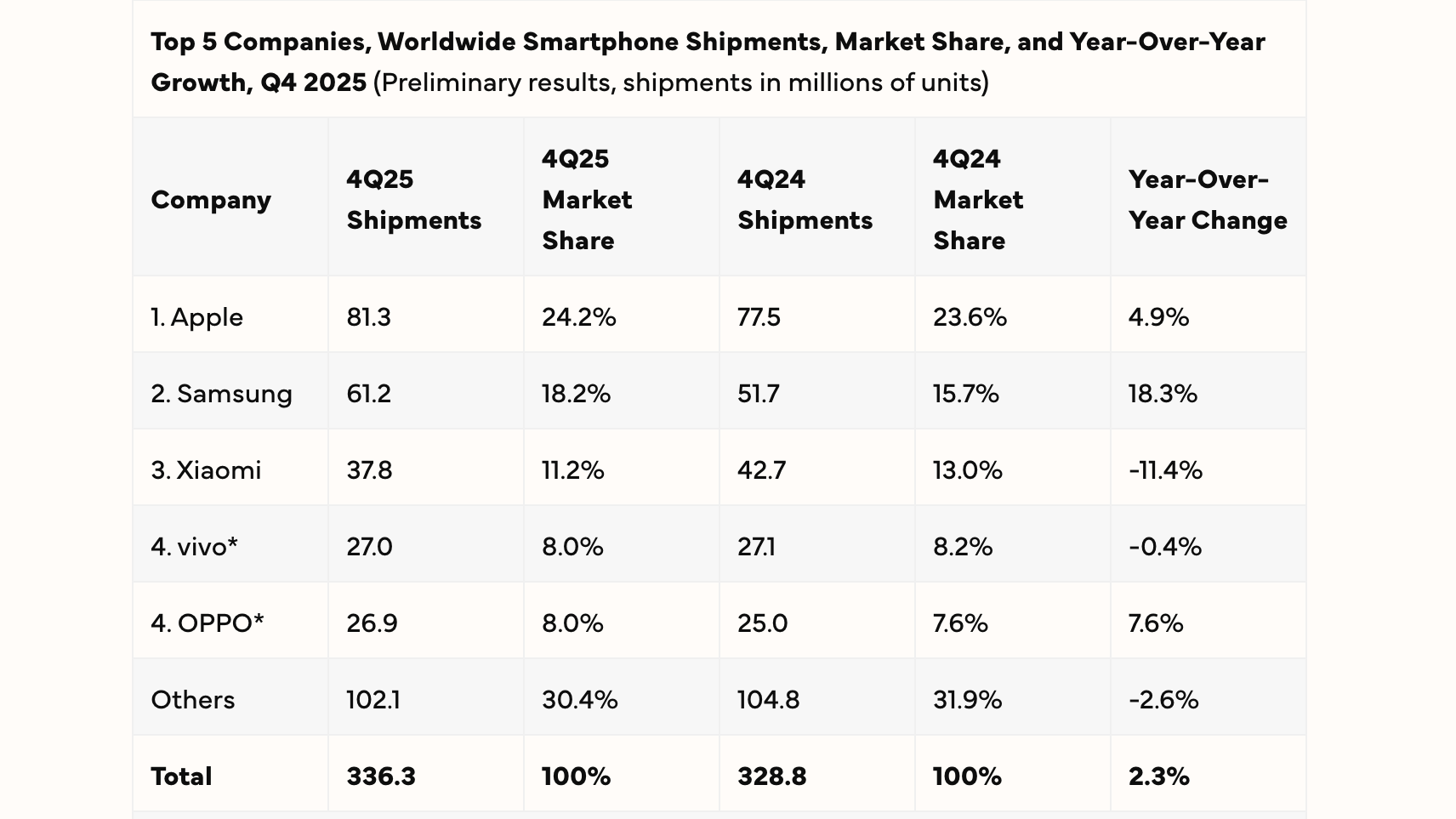

- Global smartphone shipments rose by 2.3% YoY in Q4 2025, totaling 336.3 million units.

- Samsung shot up as one of the strongest performers, shipping 61.2 million units and contributing to 18.2% of the total global market share.

- Apple leads with 24.2% market share, while Chinese brands face new challenges amidst rising competition.

The holiday season seems to have worked in favor of the global smartphone market as shipments climbed by 2.3% YoY in the fourth quarter of 2025, according to preliminary data obtained by International Data Corporation (IDC). Despite the ongoing industry issues, like memory chip shortages, unprecedented tariffs, and other disruptions, the smartphone market seems to have ended the year strong.

In total, 336.3 million smartphones were shipped globally during the quarter, bringing the full-year shipments to roughly 1.26 billion units, which is a 1.9% increase from the same time last year.

Speaking of positive numbers, Samsung shot up as one of the strongest performers, shipping 61.2 million units and contributing to 18.2% of the total global market share. IDC says that Samsung delivered its best in Q4 since way back in 2013, all thanks to “strong sales of its Galaxy Z Fold 7 and affordable AI-enabled Galaxy A-Series devices,” the report stated.

Samsung’s new foldables basically contributed to Samsung’s strongest Q3 in years, and the Galaxy Z Fold 7 sales in the US exceeded the Z Fold 6 by 50% within the same timeframe after launch. It also became the fastest-selling Galaxy Fold in Western Europe, selling more than double the units of the Z Fold 6 in its first four weeks. Giving the Korean OEM a 64% hold on the global foldable market.

Apple continued to hold its place at the top of the board, shipping over 81.3 million units, contributing to 24.2% of the global market share. Which hints at the fact that people are certainly reaching for high-end premium devices, according to Nabila Popal, senior research director for Worldwide Client Devices, IDC.

Chinese brands like Xiaomi held onto their third place with 37.8 million shipments, but the brand faced a YoY decline amid challenges like higher price points and competition from other brands within the country. Vivo and OPPO both held onto 8% of the market, shipping 27 million and 26.9 million units, respectively. IDC noted that Vivo’s growth was due to its sales and performance in India, while OPPO’s was bolstered by its new launches in China.

Meanwhile, other brands like Google, Motorola, Honor, etc that fall under the “others” category, accounted for 30.4% of the total market, down from 31.9% in the same period the previous year (4Q24).