What you need to know

- Qualcomm’s fiscal year Q1 2026 earnings are up to $12.25 billion, representing single-digit growth.

- The QTC division grew slightly, with a minimal 3% growth in headsets and $7.82 billion in revenue, and a more substantial 15% growth in automotive to $1.10 billion.

- Qualcomm’s FY Q2 2026 outlook is expected to fall in the range of $10.2B – $11.0B, below expectations.

Qualcomm reported its FY Q1 2026 financial results on Wednesday, with revenue growing to $12.25 billion, up 5% from the same period the previous year. This was driven mostly by handset sales and the company’s growing automotive efforts, as more automakers like Toyota adopt Qualcomm’s digital cockpit.

“Our momentum across personal, industrial and physical AI is growing, as evidenced by recent product announcements at CES and customer traction,” said Qualcomm CEO Cristiano Amon in a statement, highlighting the company’s total record total revenues.

“While our near-term handsets outlook is impacted by industry-wide memory supply constraints, we are encouraged by end-consumer demand for premium and high tier smartphones, and remain on track to achieve our fiscal 2029 revenue goals.”

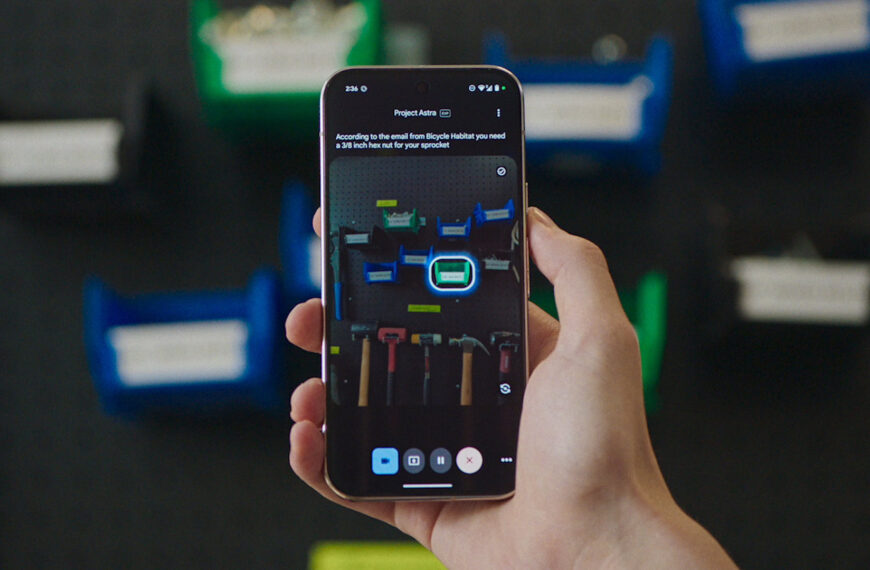

On the positive side, Amon noted during the earnings call that OEMs have adopted Qualcomm’s dual-flagship strategy, which includes the latest Snapdragon 8 Elite Gen 5 and Snapdragon 8 Gen 5, and that we have begun to see agentic AI phones coming to market.

“This is a significant milestone in the transition toward AI native smartphones in the precursor to the agentic experiences shaping the future of mobile,” Amon stated.

He also highlighted the company’s ongoing partnership with Samsung, stating that Qualcomm will have “approximately 75% share” with the Galaxy S26 series.

On the other side, Qualcomm CFO, Akash Palkhiwala, notes that increasing demand for memory solutions in AI data centers is “driving near term uncertainty in memory supply and pricing for handset OEMs.

As a result, the handset OEMs are taking a cautious approach in planning their business. We’ve seen several OEMs, especially in China, take actions to reduce their handset build plans and channel inventory.”

Because of this, Qualcomm’s outlook for Q2 2026 is notably below analysts’ expectations, with the company anticipating revenue of $10.2 billion to $11 billion.

Android Central’s take

After a relatively successful year with impressive quarterly revenue growth, Qualcomm’s lower-than-expected outlook for the quarter is quite telling. We already know that smartphone prices will likely be affected in 2026, particularly in the low and mid-range, but Qualcomm’s guidance shows how OEMs are doing their best to manage the shortage by being more cautious with inventory, too.

What’s interesting is that the growth of AI and the need for more data centers is driving the shortage, while smartphones themselves are helping drive AI adoption. It’s also becoming clear that this shortage will not abate any time soon, and Amon has even stated that they “can’t really predict if this will continue for ’27 or ’28.”

As such, it will be interesting to see how this plays out as the year goes on, as we’ve already seen phones like the OnePlus 15R go up in price.

That said, it is nice to hear that Qualcomm will retain its high share with the Galaxy S26. While Samsung has made strides to improve Exynos, it’s clear that most consumers prefer Snapdragon to Samsung’s chip, and a 75% share suggests more consumers may get their hands on devices… assuming prices don’t go up and inventory holds.