What you need to know

- Alphabet reported its Q4 2025 earnings today, revealing consolidated earnings that exceeded $400 billion for the first time.

- The company reported $113.83 billion in revenue for the quarter and a nearly 18% year-over-year revenue increase.

- Alphabet is planning a major AI-driven reinvestment for 2026 that puts projected capital expenditures between $175 billion to $185 billion.

Alphabet, the parent company of Google, released its Q4 2025 earnings in a call with investors Wednesday, Feb. 4, reporting $113.83 billion in revenue for the quarter. That amounts to a nearly 18% year-over-year revenue increase, according to the report. The growth outperformed industry projections, and Google’s cloud, services, and advertising divisions each had a strong quarter.

The company’s operating income increased by 16%, largely driven by a $2.1 billion employee compensation charge for Waymo. This follows a $16 billion investment round for Waymo announced this week, valuing the division at $126 billion. Meanwhile, Alphabet’s consolidated net income increased 30%.

Alphabet and Google CEO Sundar Pichai called it “a tremendous quarter,” noting that annual revenues exceeded $400 billion for the first time ever.

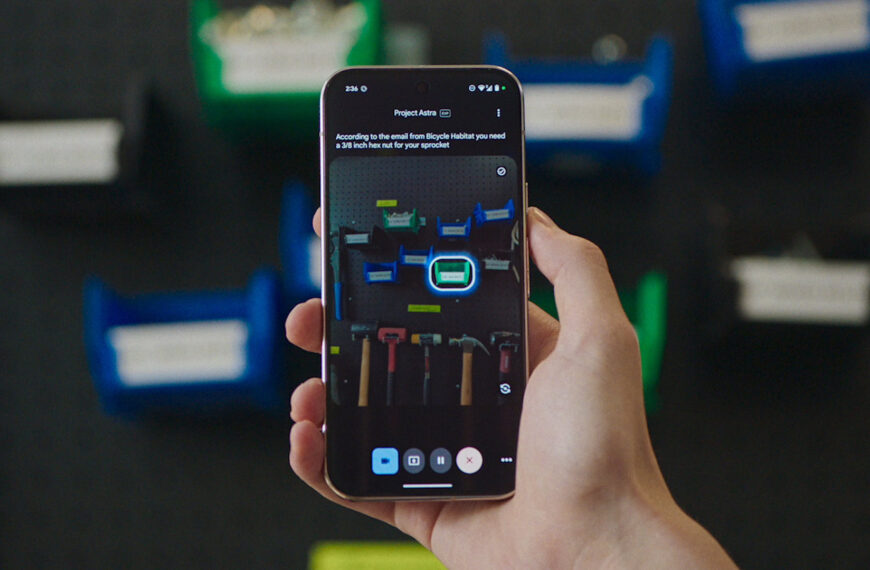

The launch of Gemini 3 was a major milestone and we have great

momentum. Our first party models, like Gemini, now process over 10 billion tokens per minute via direct API use by our customers, and the Gemini App has grown to over 750 million monthly active users. Search saw more usage than ever before, with AI continuing to drive an expansionary moment.Sundar Pichai, CEO of Alphabet and Google

Notably, Alphabet is ramping up its spending for 2026, anticipating capital expenditures to fall in the $175 to $185 billion. Alphabet’s most recent capital expenditures estimate, released alongside Q3 2025 earnings in October, was between $91 billion to $93 billion for the 2025 fiscal year. The estimate for 2026 represents nearly double the planned investment year-over-year.

Alphabet reported its first-ever $100 billion revenue quarter in Q3 2025, and continued that growth with the $113.83 billion in revenue earned in Q4 2025.

The gains came on the back of Google Cloud, which earned $17.66 billion for the quarter, representing a 48% increase. Additionally, Google Services revenues increased 14% to $95.9 billion, per the report.

Pichai said that the planned spending increase is “to meet customer demand and capitalize on the growing opportunities we have ahead of us.”

Android Central’s take

Alphabet’s big bet on artificial intelligence and cloud processing seems to be paying off. Google Cloud revenue nearly doubled year-over-year for the quarter, and the company is planning investments to increase capacity and meet customer demand. The company’s advertising business isn’t taking a hit early in the AI era, despite Gemini not currently showing ads, growing to more than $82 billion in revenue in Q4 2025.

Profits grew to $34.5 billion for the quarter, exceeding analyst expectations, which put expected profit at around $32 million, according to The New York Times.

Waymo seems to be the Alphabet division to watch moving forward. Following a massive funding round this week, Alphabet reported its “Other Bets” division — which includes Waymo — lost $3.61 billion in Q4 2025, which is a year-over-year increase of more than 200%. At the same time, Waymo completed over 15 million trips in 2025 and is establishing an early hold of the self-driving rideshare market.

Alphabet had its biggest revenue quarter ever last quarter, and continued that success with a second-straight $100B quarter. For the year, Alphabet reported $402 billion in total revenue, up from $350 billion in 2024.

It’s nothing short of a record-breaking 2025 performance for the company. The question is whether Alphabet can significantly increase investments while keeping profits on an upward trajectory.