IDC x AC

This is an exclusive column featuring expert analysts from International Data Corporation (IDC), who provide insights into the latest products, news, and more.

The smartphone industry is heading into a turbulent 2026. Rising memory prices and tight supply conditions are putting enormous strain on manufacturers, especially smaller brands that lack the purchasing power and supply chain leverage of the major players. But in the middle of this challenging environment, Google’s upcoming Pixel 10a looks surprisingly well-positioned, perhaps even more so than any A-series device before it.

The Pixel 10a will be available for pre-order on February 18, a fair bit earlier than previous A-series launches. And given the shifting market conditions, the timing could work heavily in Google’s favor.

A difficult year that also brings opportunity

The memory shortage is the defining supply chain story of 2026. With RAM and flash storage prices climbing, midrange and entry-level smartphones are being hit the hardest. Smaller brands that typically compete on aggressive pricing may be forced to scale back shipments, delay launches, or raise prices, and consumers looking for value-focused devices could find fewer compelling options this year.

This is where Google has a unique advantage. As a hyperscaler, Google consumes enormous amounts of memory for its cloud infrastructure, data centers, and AI workloads. Because of this scale, it is likely to be prioritized by memory suppliers during allocation crunches. While this doesn’t make Google immune to rising costs, it does give the company a better buffer than many mid-tier smartphone vendors.

If Google maintains its expected pricing strategy for the Pixel 10a, keeping it at the same price point of $499 as the Pixel 9a, it will stand out in a marketplace where inflationary pressure is expected to drive midrange phones upward. Price stability could become one of Pixel’s strongest selling points in 2026.

A niche global player, but smartly positioned

Even with these supply chain advantages, Google remains a relatively small player in the global smartphone market. Its geographic presence is narrow compared to giants like Apple, Samsung, and Lenovo’s Motorola brand. These companies still dominate both carrier channels and open market sales worldwide, and they hold the deepest relationships with component suppliers.

But Google’s strategic timing may help offset its smaller footprint. An early year release lets the Pixel 10a hit the market before many competitors finalize their midrange launches. It also gives Google a chance to anchor the narrative around value before rising memory costs seep further into retail pricing.

Google is also going a step further this time by specifically targeting iPhone users, offering them a more seamless means to transfer data and highlighting compatibility with AirPods, FaceTime, and other Apple staples.

In short, Google may not be the biggest smartphone maker in 2026, but it may be one of the best positioned to deliver a stable midrange product without compromise.

The important role of the A-series in Google’s lineup

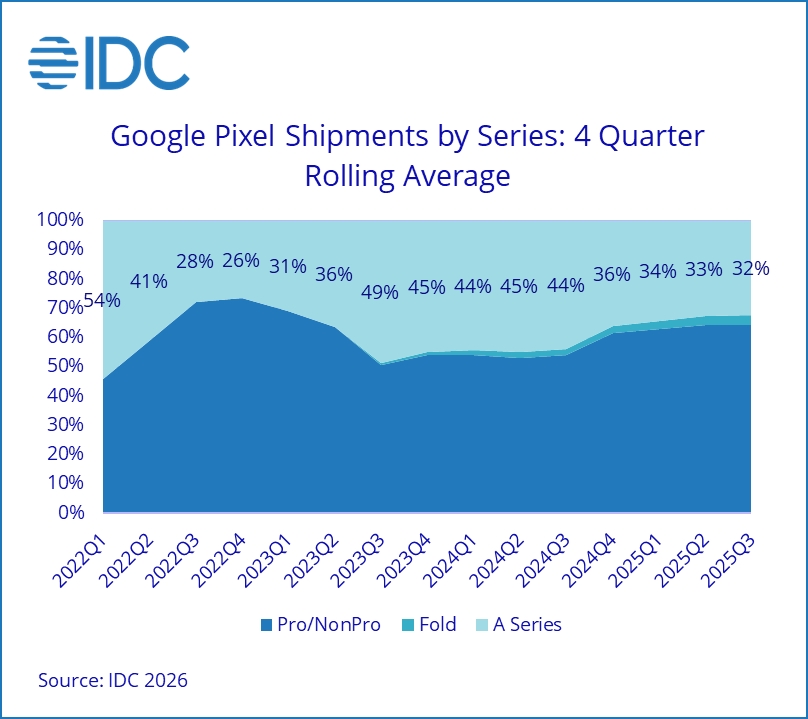

At its peak, the Pixel A-series was extremely essential to Google’s hardware strategy as it represented close to half of all Pixel shipments. However, more recently, that’s dropped to about one-third according to IDC. Still, one-third is significant enough that Google continues to invest in the A-series, and these phones appeal to a wide swath of consumers, especially those buying their devices outright instead of through carrier financing.

With smartphone average selling prices expected to rise in 2026, the A-series could grow even more important for Google. A stable, affordable price point will attract buyers who might otherwise be priced out of the midrange as competing phones inch upward in cost.

However, it’s important to set realistic expectations. Even if the Pixel 10a sees stronger demand, Google’s overall global share is unlikely to shift significantly. The brand simply does not have the expansive retail and carrier presence enjoyed by Samsung, Apple, or Lenovo. But in the markets where Pixel already performs well, such as North America, Japan, and select parts of Europe, the Pixel 10a could gain noticeable traction.

The most meaningful gains will likely come in the open market, where consumers are more sensitive to upfront cost and less reliant on financing options. Here, the combination of a stable price and Google’s expanding software capabilities could give the Pixel 10a an unusually competitive edge.

Why Pixel fans have reason to be excited

Over the past few years, one of the most exciting developments in the Pixel lineup has been the shrinking gap between the A series and the flagship models. The Pixel 10a appears poised to continue this trend. And while it may not receive the newest Tensor G5 chipset, the expected Tensor G4 still enables Google’s signature AI experiences.

On the design front, the Pixel 10a plays it safe by rehashing the design of last year’s Pixel 9a, which included the pill-shaped camera housing and clean, minimalist aesthetic. While some may wish for a more dramatic redesign, this continuity reflects a deliberate strategy: reusing the existing chassis helps Google control manufacturing costs, enabling it to prioritize pricing consistency.

The end result is a device that feels remarkably close to the base Pixel 10 or the previous 9a, just without the premium materials or the newest top-tier chip. For many consumers, that tradeoff will be more than acceptable if the price holds steady.

Motorola: The competitor to watch

The greatest obstacle facing the Pixel 10a may not be Samsung or Apple, but Motorola. Backed by Lenovo’s immense supply chain strength, Motorola sits in a similar pricing band and has been a prominent player in the midrange segment. While Motorola has been trying to move its brand upstream, its core strength still lies in accessible, high-value devices, similar to the Pixel 10a.

With Motorola unlikely to suffer the same memory allocation challenges as smaller brands, and with its mature distribution channels across Latin America, Europe, and the U.S., it remains one of the most direct competitors to Google’s A-series strategy. For the Pixel 10a to stand out, it will need to rely heavily on its software advantages, AI features, and the growing appeal of Google’s broader ecosystem.

A vital part of Google’s lineup

Despite the many challenges facing the smartphone market in 2026, the Pixel 10a is shaping up to be one of Google’s most thoughtfully timed and strategically positioned devices. Its early launch window, expected price stability, strong AI capabilities, and narrowing gap with the flagship Pixel lineup all give it a compelling story in a year when value-oriented consumers will be feeling the squeeze.

Competition from Motorola will be fierce, and Google’s global footprint remains limited. But for Pixel fans, this could be one of the most exciting A-series launches yet. With any luck, the Pixel 10a will live up to expectations and help keep the A series a vital part of Google’s smartphone future.

If it delivers on its promise, 2026 might be a challenging year for smartphones but a quietly successful one for Google’s midrange ambitions.

About IDC

IDC is a leading global provider of technology research, insights, and events. With a network of more than 1,000 analysts across over 100 countries, IDC delivers trusted intelligence on tech markets, trends, and opportunities to help businesses and IT leaders make informed decisions. Learn more today at IDC.com